Accounting Evaluate the Performance of an Organisation

Question :

Critically discuss how the Balanced Scorecard can be used as a tool for senior management to evaluate the performance of an organisation.

Answer :

Critically discuss how the Balanced Scorecard can be used as a tool for senior management to evaluate the performance of an organization.

Measurement is an important attribute of a successful organization. Senior management often get what they measure in the organization. The presence of a particular management system within the organization greatly affects the way employees and managers behave. There has been an understanding that the measures that are traditional in nature such as earnings per share, and return on investment, do not give clearer picture about the innovation and improvement or the actions that the senior management take in order to meet the demands of the competitive environment (Storey, 2002). The financial performance measures that are traditional in nature are quite apt to some extent, but were successful in the industrial period. However, these measures do not indicate the competencies and skills required in today’s competitive scenario.

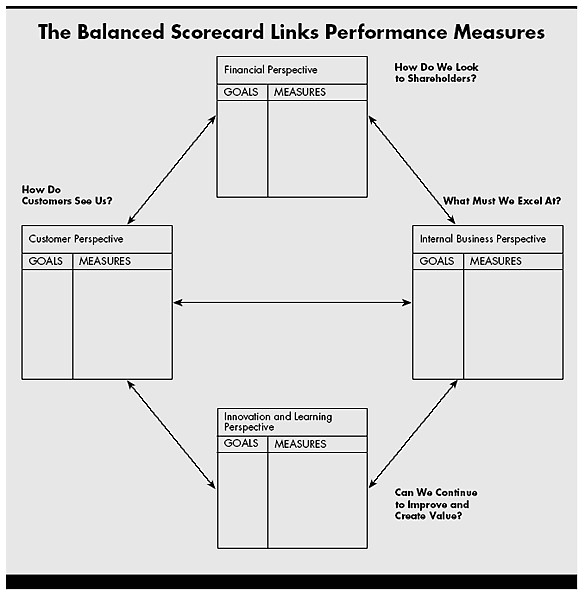

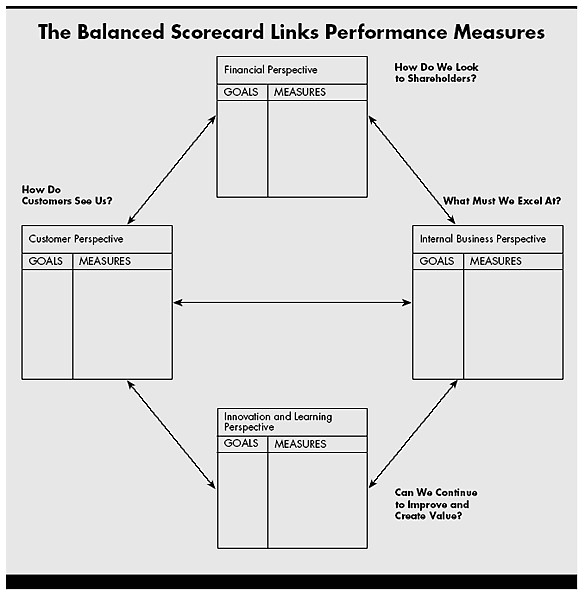

The inadequacies of the traditional system cannot be denied, and thus the researchers and managers set out to resolve the challenge. Some asserted to depend on the financial measures, whereas others asserted to focus on operational measures such as defect rates and cycle rates, and do not give much attention to financial measures (Awadallah and Allam, 2015). The studies by several researchers found that when the companies make decision actual scenario, depending on one or two measures do not give them clearer picture. They had to rely on various metrics from all business areas to make informed decisions. Therefore, the need to have measures that shows balanced picture was needed (Pessanha and Prochnik, 2006). And this is when the concept of balanced scorecard came into existence. The focus of this essay is to critically assess that how the Balanced Scorecard can be used as a tool for senior management to evaluate the performance of an organization. There are four key areas in this card, and each of them has been tackled separately to get clear picture. The diagram below shows all the areas of Balanced Scorecard:

Figure 1: Balanced Scorecard (Anan, 2014)

As it can be seen from the diagram above, there are four key areas that are considered in the balanced scorecard. They are customer perspective, financial perspective, internal business perspective, and innovation and learning perspective. Balanced scorecard can be considered as indicators and dials that are present in an airplane cockpit. As similar to flying an airplane, there is a need for managers to access the complex information of the organization in one place, whether it is speed of the airplane, its fuel level, pressure, destination, bearing, and others. All these indicators provides a summary of the existing environment as well as allow to picture upcoming scenario (Lord et al, 2005). Through this card, senior management is able to see the business from four angles and make decisions. It helps them in understanding the perception of the customers towards the company, areas where the company must make improvement, decision that whether the company should still focus on creating value and improvement, and ways to focus on the company’s stakeholders. Balanced scorecard significantly reduces information overload from the shoulders of the senior management and limits their focus on the most important numbers and metrics. It often happens that based on the continuous suggestions from consultant or employees, the company ends up having several measures that eventually creates more chaos than provides solution. Here, the balanced scorecard comes to rescue by focusing on selective and highly critical measures.

Though balanced scorecard has been considered as appropriate and useful, there are several criticisms of this method that should not be denied as well. Scholars have argued that the card is not built upon proven financial or economic theory, and has not come up from decision sciences (Kaplan, 2010). It has been argued that the design of the balanced scorecard is rather subjective, without having strong basis in economic or actuarial background. Criticism about the efficiency of the Balanced Scorecard’s in planning for business has also come into the picture. The scholars argued that it does not offer unified perspective over all the possible metrics of the organization (Norreklit, 2003). Some suggest that whether the Balanced Scorecard is beneficial depends on the strategy of the business, and thus the senior management may end up focusing on the areas in the card that are supportive of the strategic decisions they have made. And they may end up ignoring the areas that are not showing measurable or direct impact on the goals of the organization (Isoraite, 2008). Here, it is quite understandable that shareholders and creditors are often touted as the most important entity of the organization and they are always valued by the senior management, therefore, there exists possibility of inclination towards financial perspective of the organization in the scorecard. Such biasness is likely to render Balanced Scorecard imbalanced, and thus less useful.

Perspective of Customers

There is no doubt that the customers stay the focus of corporate missions of several companies. Therefore, understanding the performance of the organization from the perspective of the customers has been taken as priority by the senior management. With the scorecard, managers are expected to convert their mission statement about customer service into measures that are specific and reflect the variables that are actually important for the customers. Time, performance, quality, and service are the four areas in which the concerns of customers fall. In order to improve the customers’ satisfaction by focusing on all these four areas, the companies are expected to convert these into measurable metrics (Dror, 2008). It often happens that the companies fail to assess their performance from the customers’ perspectives, and thus they hire external agencies who can do anonymous surveys that can provide report card which is customer driven. As for instance, in the automobile industry, quality survey J.D. Powers is often utilized in this regard to gain unbiased review. Companies also use benchmarking method is another method that is used by the company to compare its own performance in comparison to others in the market. In most cases it has been found that the companies try to see the best in each of the industries and try to inculcate within it. As for instance, taking process of lower payroll cost form one industry, and taking excellent distribution process from another industry. However, it has to be understood that measures related to performance, quality, time, and service should stay sensitive towards the products cost (Anand et al, 2005). However, customers almost always look at the price as the single element when engaging with the suppliers. There are various other costs that are supplier driven such as ordering, paying, scheduled delivery, handling, receiving, disruptions in schedule, wrong delivery, and others. Here, it is important all the factors are taken into perspective, and it would be worthwhile paying higher price for the supplier that stand on most of the criteria.

Internal Business Perspective

So far the discussion on customer-based perspective seems important, however, the focus must be brought inside the organization as it is the internal process that ensure to meet the expectation of the customers. If the internal processes are not smooth, decision making is not timely, and actions are taken properly, then rarely it will happen that the customers will get expected level of service. Therefore, there is a need to focus on all the operations within the organization that convert to customer satisfaction. The measures that are to be included in the balanced scorecard should come from the processes that are going to have major impact on the satisfaction of the customers such as productivity and skills of employees, product quality, cycle time, and others (Bontis et al, 2007). In this, companies are expected to find the measure that are strongly connected to the core competencies of the company, and it is expected to include only those technologies that will help it to stay leader in the market. Here, one challenge with the handling of the internal business perspective is of information. The role of information is vital to ensure that the managers are able to disintegrate the measures on the balanced scorecard and trace back to the problem itself to resolve it. If the measures on the scorecard does not allow it, then having the score is not going to resolve any problem. Therefore, tracing back is as important as integrating all the data points and building a scorecard (Atkinson, 2006). This ensures that even the employees at the lowest level in the organizational hierarchy are able to get access to goals that are clear so that they can take appropriate actions as well improve their actions wherever necessary.

However, it generally happens in the organizations that information are not readily available and it becomes Achilles’ heel in improving the performance of the organization. Another concern that often plague the internal process is untimely access to information (Mooraj et al, 1999). Timely accessibility of information ensures that the managers do not end up making decisions for the problems that have already crossed the level at which it could be handled at minimal resource consumption.

Innovation and Learning Perspective

So far, internal business process and customer focused measures have been assessed in the previous two sections. These two identify the metrics that are key for the survival and success in the competitive market for the company. However, it can be witnessed that targets that define success often changes. And the reason can be attributed to changing global competitive scenario that forces companies to continued improvement in the processes they are utilizing or the products they are selling. Or even further, they are expected to launch new products to continuously keep the customers interested (Johanson et al, 2006). Value of the company is strongly connected with its ability to learn, innovate, and improve. Penetration of companies in new market, or the increase in the margins and revenues can only take place if companies are continuously improving its efficiencies and value for customers. Moreover, even value for shareholders can only increase if the company is growing. There are various goals in this perspective that are adopted by the companies such as leadership in technology, product quality or feature increase, timely entry to the market, or improving learning in manufacturing.

Financial Perspective

Finance is the bottom line of the company, and whatever companies do, if their bottom line is not improving, the effort cannot be considered worthwhile. The strategy of the company, its implementation, and execution, all should align towards boosting the bottom line. Financial goals can be different depending on the company’s overall goals such as surviving, succeeding, or prospering. All these are expected to relate with the growth, profitability, and value for shareholders. However, considering the current volatile business environment, whether senior managers should consider financial perspective is the question that needs answering (Othman, 2008). Reason is that all the financial measures push the senior management to keep the attention at the short term goals such as operating income generated by the company or the sales made on a quarterly basis, and others. Financial measures have been criticized by several in the past due to the backward focus, and the lack of ability of these measures to reflect and understand the current actions that are creating values. However, measures like SVA (shareholder value analysis) tries to look forward and make the financial analysis futuristic. SVA discounts back the estimated future cash flow to the current value. However, still the dependency of SVA is on the cash flow instead on the processes and activities within the organization that is driving flow of cash. There are several other criticisms of financial measures by scholars asserting that the competitive market scenario is continuously changing and completely depending on traditional financial measures bring no good in improving the motivation of employees, product quality, satisfaction of customers, or others (Abdullah et al, 2013). Studies further assert that performance on the financial front can just be considered as the consequence of doing the right things right. It entails that instead of focusing on financial measures, companies should improve in the key fundamental areas related to its operations. However, not getting financial measures will also not push the organization towards success, and thus it is where having financial perspective on the balanced scorecard is important as well. Despite its criticism, it cannot be ignored.

Based on the studies so far, it can be concluded that the balanced scorecard focuses on improving the fundamental aspects of the company that increases its performance. One criticism of balanced scorecard is that it cannot be implemented at department or project level alone by middle managers. Reason is that in order to improve on all parameters, balanced scorecard require holistic picture of the entire organization. Therefore, it requires strong involvement of senior management. Here, if the senior management is unwilling to complete the scorecard, then it will be less likely that there can be needed fundamental improvements. Seniors management holds complete picture of the organization, they know what matters most to the company, and where the company is heading. This can be considered as quite a unique take in improving the organizational performance, because the traditional focus have always been from financial angle, and normally there are financial experts who would make decisions in this regard. And it generally happens that financial experts rarely engages with senior management as heavily as the balanced scorecard. The traditional method of keeping finance at the front shows control bias. In this method, the system focused on actions that are expected by the employees. And in the end of the day, the system would measure that whether the required actions have been taken by the employees.

However, after bringing the balanced scorecard in the picture, it can be said that it forces the organization to become what it wants. Instead of control, the scorecard brings in strategy and vision at the center of everything that the organization does. No doubt it determines goals as well, however, it also makes assumptions that individuals will engage in different behaviors and actions needed to reach the intended goals. The measures present in the balanced scorecard ensures that the entire organization is brought towards the vision of the organization instead of individual pieces.

References

Abdullah, I., Umair, T., Rashid, Y. and Naeem, B., 2013. Developments on balanced scorecard: a historical review. World Applied Sciences Journal, 21(1), pp.134-141.

Anand, M., Sahay, B.S. and Saha, S., 2005. Balanced scorecard in Indian companies. Vikalpa, 30(2), pp.11-26.

Anon 2014. Measuring Process Performance. In: Business Process Change. [online] Elsevier.pp.109–129. Available at: http://dx.doi.org/10.1016/B978-0-12-800387-9.00005-0

Atkinson, H., 2006. Strategy implementation: a role for the balanced scorecard?. Management Decision.

Awadallah, E.A. and Allam, A., 2015. A critique of the balanced scorecard as a performance measurement tool. International Journal of Business and Social Science, 6(7), pp.91-99.

Bontis, N., Bart, C.K., Bose, S. and Thomas, K., 2007. Applying the balanced scorecard for better performance of intellectual capital. Journal of intellectual capital.

Dror, S., 2008. The Balanced Scorecard versus quality award models as strategic frameworks. Total Quality Management, 19(6), pp.583-593.

Isoraite, M., 2008. The balanced scorecard method: From theory to practice. Intelektine ekonomika, (1).

Johanson, U., Skoog, M., Backlund, A. and Almqvist, R., 2006. Balancing dilemmas of the balanced scorecard. Accounting, Auditing & Accountability Journal, 19(6), pp.842-857.

Kaplan, R.S., 2010. Conceptual foundations of the balanced scorecard (Harvard Business School, Working Paper 10-074). Retrieved at January 25, 2016.

Lord, B.R., Shanahan, Y.P. and Gage, M.J., 2005. The balanced scorecard: a New Zealand perspective. Pacific Accounting Review.

Mooraj, S., Oyon, D. and Hostettler, D., 1999. The balanced scorecard: a necessary good or an unnecessary evil?. European Management Journal, 17(5), pp.481-491.

Nørreklit, H., 2003. The balanced scorecard: what is the score? A rhetorical analysis of the balanced scorecard. Accounting, organizations and society, 28(6), pp.591-619.

Othman, R., 2008. Enhancing the effectiveness of the balanced scorecard with scenario planning. International Journal of Productivity and Performance Management.

Pessanha, D.S.D.S. and Prochnik, V., 2006. Practitioners' opinions on academics' critics on the balanced scorecard. Available at SSRN 1094308.

Storey, A., 2002. Performance management in schools: could the balanced scorecard help?. School Leadership & Management, 22(3), pp.321-338.